GP Fund Interest Rates 2023 Pakistan – 8171 Today Update PK

gp fund interest rates 2022-23 pakistan

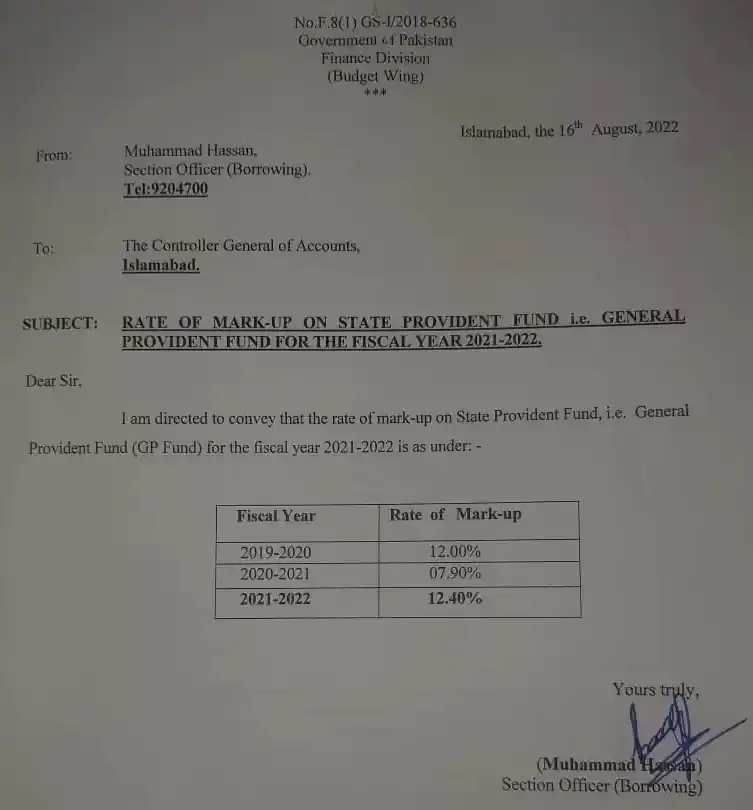

GP Fund Interest Rates 2024 Pakistan rates of return of up to 12.40% per annum will apply during the fiscal year 2022 to the State Provident Fund, i.e., the General Provident Fund. GP Fund Interest Rates 2024 Pakistan by the Government of Pakistan and the Ministry of Finance of Pakistan has issued an official notice letter regarding the GP Fund Interest Rates 2024 Pakistan for federal civil servants. According to the letter, the revised surcharge rate on the state reserve fund, i.e., the General Provident fund, for the 2022-23 financial year is as follows.

GP Fund Interest Rates 2023 Pakistan

Today, we share information about GP Fund Interest Rates 2024 Pakistan with you. The mark-up on State Provident, i.e., to the general Provident Fund (GP Fund) for the 2022-23 fiscal year, is as follows:

Check out the related article BPS Salary Chart 2022-23 | House Rent, Basic Pay, Complete Information

Chart of GP Fund Interest Rates 2024

It comes to know that it has been decided to fix the GP fund interest rates up to 12.40% profit rate up to 12.40% per annum. The profit rate will be applied to the Provident Fund during the 2022 financial year, i.e., to the General Provident Fund. Related Article: Punjab Pay Scale Chart 2023 Revised Notification – Today Update Pk

| S.No. | Fiscal Year | Rate of Mark-up |

| 1 | 2018-2019 | 14.35% |

| 2 | 2019-2020 | 12.00% |

| 3 | 2020-2021 | 07.90% |

| 4 | 2021-2022 | 12.40% |

Govt Employees GP Fund Deduction Rate Monthly 2022

| BPS | Old GP fund rate | New GP fund rate | Difference |

| 1 | 400 | 600 | 200 |

| 2 | 710 | 1059 | 349 |

| 3 | 770 | 1148 | 378 |

| 4 | 830 | 1230 | 400 |

| 5 | 890 | 1324 | 434 |

| 6 | 950 | 1418 | 468 |

| 7 | 1010 | 1498 | 488 |

| 8 | 1070 | 1595 | 525 |

| 9 | 1140 | 1691 | 551 |

| 10 | 1210 | 1795 | 585 |

| 11 | 1290 | 1915 | 625 |

| 12 | 2220 | 3298 | 1078 |

| 13 | 2400 | 3565 | 1165 |

| 14 | 2620 | 3890 | 1270 |

| 15 | 2890 | 4290 | 1400 |

| 16 | 3340 | 4958 | 1618 |

| 17 | 4270 | 6342 | 2072 |

| 18 | 5360 | 7958 | 2598 |

| 19 | 7180 | 10651 | 3471 |

| 20 | 8050 | 11944 | 3894 |

| 21 | 8940 | 13258 | 4318 |

| 22 | 9880 | 14653 | 4773 |

New General Provident Fund Subscription Rates 2022-23

The Pakistan Department of Finance issued a final notice dated 31 August 2022 concerning the uniform rates of contributions to the general provident fund. The undersigned is invited to refer to the OM of the Financial Department No. F.1(5)-Reg.

7/87-365 of 24.07.2017 on the above issue and indicate that in connection with the revision of the pay scales of civil servants of the Federal Government, distributed by OM F.1(2)Imp/2022-283 of the Finance Department of 07.01. 2022, it was decided to revise the amount of the contribution to the general provident fund by the existing rates, as shown in column 5. of the following table. Also check Basic Pay Scale Chart 2022 23 Sindh Government

Make deductions from employees’ wages at the new rates in September with payment on October 1, 2022, until further notice. Postponement of subscription to the specified fund is not allowed during vacation (except special leave without pay) or the study period. Check out Basic Pay Scale Chart 2022 Punjab Government

GP Fund Rates History 2023 | GP fund interest rates 2022-23 Pakistan

These GP Fund Interest Rates in 2023 Pakistan are the lowest since 1972. These rates are the lowest since 1972–1973. These rates ranged from 3% to 7.25% until 1972-73. In 1997–1998, the highest GP Fund Interest Rate in Pakistan’s history was 22,763.

For the same proof, you can see the GP fund interest rates since 1954. At first, markup rates rose, peaking at over 22%. This year, they have dropped significantly. This notice will make employees happier if they receive interest from their General Provident fund.

Where employees can use GP fund markup 2023:

We can use the newly announced markup for many purposes. These tariffs can be used for the following purposes:

- Calculation of interest on the General Provident fund for a subscription to the general practice fund

- Accrual of interest on advance payments for motorcycles/car advances

- Calculate interest on advance payment for building a house

GP Funds Interest Subscription

The accounting department deducts the amount of the General Provident fund from the invoices every month. These rates apply to GP Fund Interest Rates 2022 Pakistan, the General Provident Fund, until June 2022.

This rate does not apply to employees with an interest-free general General Provident Fund 2023. This category of workers receives an interest-free loan for constructing a house, motorcycle/car. Employees not registered with the newspaper do not pay interest on their HBA.

Calculate interest on a house building advance

Non-gazetted employees or employees who do not earn GP fund interest will be required to pay no HBA interest. They will receive an interest-free advance for the construction of the house.

Gazetted employees and employees who earn interest on their GP fund will be required to pay interest on HBA. The HBA rate for employees who received an HBA between July 1, 2021, and June 30, 2022, is 7.90.

Calculation of the Interest on Motorcycle Advance/Motorcar Advance

Employees receiving a GP Fund Interest Rates 2023 Pakistan allowance will be required to pay interest on advance payments for a car or motorcycle. These rates will be used to calculate Motorcycle Advance / Motorcar Advance interest. These advances will pay interest at a rate of 7

.90% to employees who receive them between July 1, 2021, and June 30, 2022.