Punjab Pay Scale Chart 2023 Revised Notification – Today Update Pk

The Punjab Pay Scale Chart 2023 Revised Notification is a set of guidelines that determine the salaries of government employees in the province of Punjab. The chart is created and maintained by the government of Punjab and is updated periodically to reflect changes in the cost of living and other economic factors. The chart is divided into different levels or grades, each corresponding to a specific pay range.

Related Article: Daily Wages Salary Notification 2023 – Today Update Pk

The pay scales for government employees in Punjab are generally based on the recommendations of the Sixth Pay Commission, which was implemented in 2008. The government reviews them from time to time. The pay scale chart determines employees’ salaries in various departments, including education, health, and public works, as well as employees of local bodies and autonomous bodies. Related Article: GP Fund Interest Rates 2023 Pakistan ( GP Fund Interest Formula )

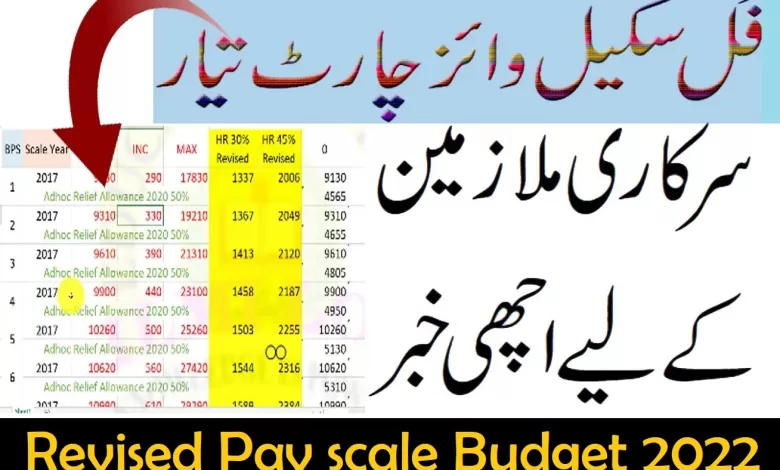

Punjab Government Finance Department issued the latest notice on July 21 2022, due to the revision of the Punjab pay scale chart for 2023 with annual allowances, special allowances, etc.The Governor of Punjab was pleased to authorize a review of the basic salary scales and allowances from July 1 2022, for the civil servants of the Government of Punjab, detailed in the following paragraphs. Reference:

Punjab Govt Employees ARA 2023 35% on Running Basic Pay

The Base Pay Scale – 2022 replaces the Base Pay Scale – 2017 and comes into effect on July 1, 2022, as specified in Appendix 1 to this notice. Related Article: BPS Salary Chart 2022-23 | House Rent, Basic Pay, Complete Information

Fixation of Pay of the Existing Employees:

- Fixing the wages of current employees at a level appropriate to their position. Above the minimum base wage scale – 2017;

- If an employee receives a Personal Payment on their base salary over the maximum of their pay scale on 30-06-2022, they must continue to receive such payment on the 2022 Base Pay Scale at revised rates.

Related Article: PM Laptop Scheme Online Registration 2023 – How To Apply

Fixation of Pay on Promotion:

In cases of promotion from lower positions/scales to higher positions before the introduction of these scales, the wages of workers affected by the revised wage scale may be set and increased in such a way that they are not less than the wage that would be acceptable for him if his promotion to a higher position/scale occurred after the introduction of these scales. [ New Update Punjab Pay Scale Chart 2023 ]

Punjab Annual Increment:

Annual increases are still allowed, subject to existing conditions, on December 1 of each year.

Special allowances in Punjab :

After the introduction of BPS-2022, the following temporary benefits granted on 01/07/2016, 01/07/2017, 01/07/2018, 01/07/2019 and 01/07/2021 will cease to exist from 01-07-2022:

| S.No | Name of Ad-hoc Relief Allowance | Admissible Rates |

| i | Adhoc Relief Allowance-2016 (01-07-2016) | 10% of the basic pay on BPS-2016 |

| ii | Ad-hoc Relief Allowance-2017 (01-07-2017) | 10% of the basic pay on BPS-2017 |

| iii | Ad-hoc Relief Allowance-2018 (01-07-2018) | 10% of the basic pay on BPS-2017 |

| iv | Ad-hoc Relief Allowance-2019 (01-07-2019) | 10% of the basic pay on BPS-2017 (BPS 1-16) and 5% of the basic pay on BPS 2017 (BPS 17-20). |

| v | Ad-hoc Relief Allowance-2021 (01-07-2021) | 10% of the basic pay on BPS-2017 |

Adhoc Relief Allowance-2023 Punjab

- Adhoc Relief Allowance 2022 @ 15% of the current Basic Pay Scale Base Salary – 2017 will be allowed for provincial government civil servants, including paid contingent and contract employees employed in civilian positions in the base pay scale under standard terms. On the appointment of the contract on 07-07-2022 will be frozen at the same level until further Notice;

- All new members will be allowed Adhoc Relief Allowance 2022 of 15% of the BPS-2017 Minimum Base Wage on a conditional basis effective from 01-07-2022 until further notice, and it must be frozen at the same level. Level.

- Adhoc Relief Allowance is subject to income tax.

- Adhoc Relief Allowance will be allowed during the leave and the entire LPR period, excluding regular leave.

- Adhoc Relief Allowance will not be considered part of the award for calculating pension/benefit and housing rent reimbursement.

- Adhoc Relief Allowance will not be provided to employees during their posting/business trip abroad.

- Adhoc Relief Allowance would be provided to employees upon their repatriation from business trips/business trips abroad in the amount and amount that would be allowed for them if they were not posted abroad.

- Adhoc Relief Allowance will be allowed during the suspension period.

- The term “base salary” will also include the amount of the personal payment provided in connection with the annual increase(s) above the maximum amount of the existing salary scale.

Related Article: Basic Pay Scale Chart 2022 23 Sindh Government

Special Pay and Allowances:

All special allowances, special allowances or allowances allowed as a percentage of salary equal to or greater than one month’s base salary, including the executive performance allowance provided to a provincial government employee regardless of their position in all administrative departments/affiliated departments / autonomous bodies. / Positions, etc., including civil servants in BPS-1-22 of the Judiciary, are frozen at the level of its admissibility as of 06/30/2022.

Option:

- All existing civil servants (BS-1 to 22) of the Government of Punjab must, within 30 days from the date of issuance of the Notice, implement the option in writing and inform the Punjab Chief Accountant/District Accountant/DDO. Interested as the case may be, interested parties continue to receive wages per the Base Pay Scales 2017 or the Base Pay Scales 2022 set out in this Notice. Once exercised, the option is considered final.

- An existing employee, as above, who does not implement and communicate their choice within the specified time frame is deemed to have opted for the 2022 Basic Pay Scale Scheme.

All existing rules/orders on this subject are considered to be modified to the extent indicated above. All current regulations/orders not limited in this way continue to operate by this scheme.

Punjab Basic Pay Scales of the Civil Servants

| BPS | MIN | INCR | MAX | Stages | MIN | INCR | MAX |

| 1 | 9,130 | 290 | 17,830 | 30 | 13,550 | 430 | 26,450 |

| 2 | 9,310 | 330 | 19,210 | 30 | 13,820 | 490 | 28,520 |

| 3 | 9,610 | 390 | 21,310 | 30 | 14,260 | 580 | 31,660 |

| 4 | 9,900 | 440 | 23,100 | 30 | 14,690 | 660 | 34,490 |

| 5 | 10,260 | 500 | 25,260 | 30 | 15,230 | 750 | 37,730 |

| 6 | 10,620 | 560 | 27,420 | 30 | 15,760 | 840 | 40,960 |

| 7 | 10,990 | 610 | 29,290 | 30 | 16,310 | 910 | 43,610 |

| 8 | 11,380 | 670 | 31,480 | 30 | 16,890 | 1,000 | 46,890 |

| 9 | 11,770 | 730 | 33,670 | 30 | 17,470 | 1,090 | 50,170 |

| 10 | 12,160 | 800 | 36,160 | 30 | 18,050 | 1,190 | 53,750 |

| 11 | 12,570 | 880 | 38,970 | 30 | 18,650 | 1,310 | 57,950 |

| 12 | 13,320 | 960 | 42,120 | 30 | 19,770 | 1,430 | 62,670 |

| 13 | 14,260 | 1,050 | 45,760 | 30 | 21,160 | 1,560 | 67,960 |

| 14 | 15,180 | 1,170 | 50,280 | 30 | 22,530 | 1,740 | 74,730 |

| 15 | 16,120 | 1,330 | 56,020 | 30 | 23,920 | 1,980 | 83,320 |

| 16 | 18,910 | 1,520 | 64,510 | 30 | 28,070 | 2,260 | 95,870 |

| 17 | 30,370 | 2,300 | 76,370 | 20 | 45,070 | 3,420 | 113,470 |

| 18 | 38,350 | 2,870 | 95,750 | 20 | 56,880 | 4,260 | 142,080 |

| 19 | 59,210 | 3,050 | 120,210 | 20 | 87,840 | 4,530 | 178,440 |

| 20 | 69,090 | 4,510 | 132,230 | 14 | 102,470 | 6,690 | 196,130 |

| 21 | 76,720 | 5,000 | 146,720 | 14 | 113,790 | 7,420 | 217,670 |

| 22 | 82,380 | 5,870 | 164,560 | 14 | 122,190 | 8,710 | 244,130 |

Abnormalities :

Anomalies about Punjab Pay Scale Chart 2023, if any, arising from applying the Base Pay Scale – 2022 must be referred to the Complaints Committee established in the Punjab Government Finance Department (Regulatory Wing).

Related Article: Basic Pay Scale Chart 2022 Punjab Government

What is the current pay scale for government employees in Punjab?

The current pay scale for government employees in Punjab is based on the recommendations of the Sixth Pay Commission, which was implemented in 2008. The government of Punjab reviews and revises the pay scales periodically to consider changes in the cost of living and other economic factors.

How are the pay scales for government employees in Punjab determined?

The government of Punjab determines the pay scales for government employees in Punjab. The pay scales are usually divided into different levels or grades, with each level corresponding to a specific pay range. Factors such as the employee’s qualifications, experience, and job responsibilities are considered when determining the pay scale.

Is the pay scale for government employees in Punjab the same for all departments?

No, the pay scale for government employees in Punjab can vary depending on the department. For example, employees in the education department may have a different pay scale than employees in the health department.

Are any benefits associated with the pay scale for government employees in Punjab?

Yes, in addition to the basic salary, government employees in Punjab may also be eligible for various benefits such as medical coverage, retirement benefits, and other perks.

How often are the pay scales for government employees in Punjab reviewed and revised?

The pay scales for government employees in Punjab are reviewed and revised periodically. The Punjab government regularly reviews the pay scales to consider changes in the cost of living and other economic factors.

Are the pay scales for government employees in Punjab similar to those in other provinces of Pakistan?

The pay scales for government employees in Punjab may be similar to those in other provinces of Pakistan. Still, they can vary depending on the region and their respective pay commission recommendations.

How can I find more information about the pay scale for government employees in Punjab?

More information about the pay scale for government employees in Punjab can be obtained from the government of Punjab’s website or by contacting the relevant government department.