Latest News: KPK Apna Karobar Loan Scheme Lunched By KPK

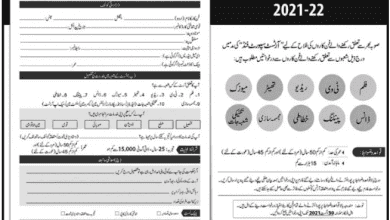

Today Updated News is about KPK Where KPK Apna Karobar Loan Scheme Lunched By KPK Goverment. The Government of Khyber Pakhtunkhwa (KPK) has introduced the Apna Karobar Easy Installments Loan Program for 2024.

This scheme supports small and medium-sized enterprises (SMEs) by providing financial aid to foster economic growth, create job opportunities, and reduce poverty. The program helps entrepreneurs start or expand their businesses with minimal financial strain. One of the best program for the students of Punjab started by goverment Named “Modern Skills Scheme” Don’t Late Apply Now.

Apna Karobar KPK Easy Installments Loan Program

The Apna Karobar KPK Easy Installments Loan Program aims to boost economic development in the region. By offering easy-to-access loans with flexible repayment plans, the program encourages entrepreneurship and innovation. This initiative is part of a broader effort to strengthen the economic infrastructure of KPK and help the local population achieve financial stability. I have more special news for you New Update Akhuwat HBL Bank Personal Loan Scheme 2024 get loan from this.

| Feature | Details |

| Loan Amount | Up to PKR 1,000,000 |

| Interest Rate | 5% – 7% per annum |

| Repayment Period | 1 to 5 years |

| Grace Period | Up to 6 months |

| Collateral | May be required depending on the loan amount |

| Processing Time | 2 to 4 weeks |

| Application Fee | PKR 1,000 – 5,000 |

What Is Eligibility Criteria KPK Apna Karobar Loan Scheme?

To ensure that the loans reach those who need them most, the program has specific eligibility criteria:

- Resident of KPK: Applicants must be residents of “Khyber Pakhtunkhwa“.

- Age Limit: Individuals aged between 18 and 50 years can apply.

- Business Type: Both existing business owners and new entrepreneurs are eligible.

- Business Plan: A feasible and comprehensive business plan is required.

- Credit History: Applicants should not have any significant negative credit history.

Apna Karobar KPK program Loan Features

The “Apna Karobar KPK program” offers several beneficial features to ensure the loans are accessible and affordable. Borrowers can get loans ranging from PKR 50,000 to PKR 500,000.

Read Also: Today Update: Ehsaas Program 25000 New Payment Released

| eature | Details |

|---|---|

| Loan Amount | PKR 50,000 to PKR 500,000 |

| Interest Rate | Competitive rates to minimize financial burden |

| Repayment Period | Flexible terms ranging from 1 to 5 years |

| Grace Period | Initial grace period before the start of repayment |

| Collateral | Minimal collateral requirements to facilitate easier access |

What is Application Process for Apna Karobar Loan Scheme?

The application process for the Apna Karobar KPK Easy Installments Loan Program is simple and accessible:

- Online Application: Apply online through the official portal.

- Documentation: Submit necessary documents including ID, business plan, and financial statements.

- Verification: Thorough verification of submitted documents and eligibility criteria.

- Approval: Successful applicants will receive approval and loan disbursement details.

- Disbursement: Loans will be disbursed promptly to facilitate immediate use.

FAQS

What is the purpose of the KPK Apna Karobar Loan Scheme?

The scheme supports SMEs by providing financial aid to foster economic growth, create job opportunities, and reduce poverty.

How much can I borrow under this Apna Karobar scheme?

You can get loan between PKR 50,000 and PKR 500,000.

Conclusion

The Apna Karobar Easy Installments Loan Program by the KPK government is a commendable initiative aimed at bolstering the local economy by supporting SMEs. By providing accessible and affordable financial aid, this program paves the way for aspiring and existing entrepreneurs to thrive, thereby creating job opportunities and reducing poverty.

The streamlined application process and flexible repayment terms further ensure that financial assistance is within reach for those who need it most. This initiative not only promotes economic growth but also fosters a culture of innovation and entrepreneurship in Khyber Pakhtunkhwa.