How To Calculate Income Tax On Salary In Pakistan With Example 2024

How To Calculate Income Tax On Salary In Pakistan, Income tax is a direct tax that all governments levy on the income from working citizens and businesses. Pakistan’s current taxation system is determined by the Income Tax Ordinance 2001 for direct taxes and administered by the Federal Board of Revenue (FBR).

This Ordinance directs the collection of this tax by the central government. The government can independently change the amount of income and tax rates every year in its annual budget. The period from 1 July to 30 June is considered an ordinary financial year for Pakistan’s tax law. If you wonder how to calculate payroll income tax in Pakistan, we can help you.

Related Article: Motorcycle Registration Number Check 2024 | Bike Registration Check

An income tax provides revenue to the government to finance public services, pay government obligations, and provide goods to citizens. Income is not only money earned as a salary. It also includes rent on personal assets such as homes or shops, business profits, bonuses, capital gains, and “income from other sources.”

Today, the corporate income tax rate has been 29% since 2019, while the corporate tax rate is 35% for the banking industry. Other applicable income taxes include excess tax, minimum tax, and tax on retained reserves.

Related Article: Daily Wages Salary Notification 2024 – Today Update Pk

How To Calculate Income Tax On Salary With Example In Pakistan 2024

According to the Income Tax Ordinance 2001, the wages you receive at home each year fall into the following categories: How To Calculate Income Tax On Salary In Pakistan.

- Basic Salary

- House Rent Allowance (HRA)

- Conveyance Allowance

- Medical and Other Allowances

Vehicle Smart Card Status Check Online Islamabad 2024

How To Calculate Income Tax On Salary In Pakistan in 2024

Online method

1. Go to Income Tax Calculator

2. Enter your income

3. Click whether you want to enter monthly or annual income

4. Click “Calculate”

5. The results will be shown below, along with the applicable tax, wages after-tax, the amount exempted, and the tax bracket you are subject to about How To Calculate Income Tax On Salary In Pakistan.

Related Article: How To, IESCO Bill Online Check | Check IESCO duplicate bill 2024

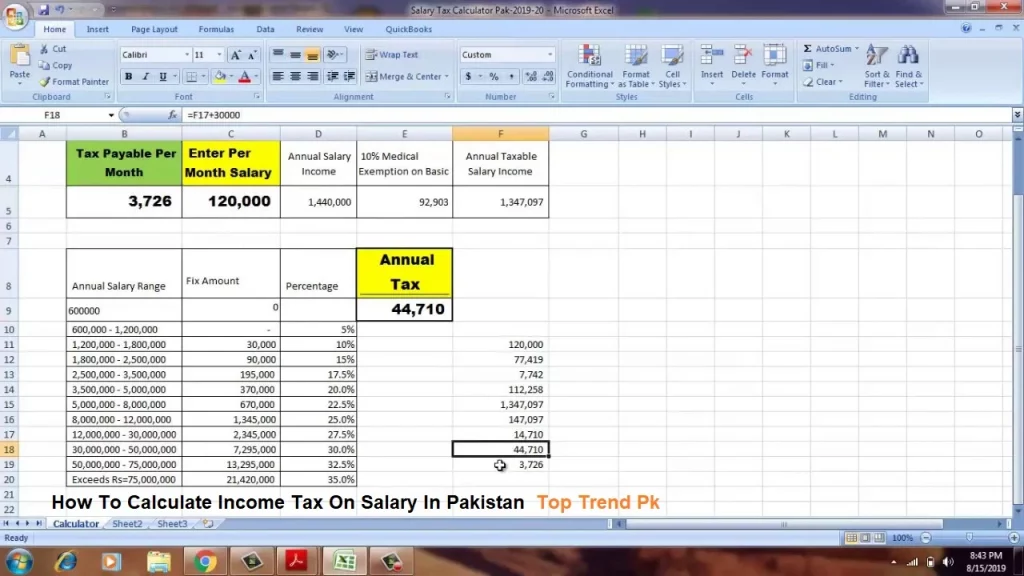

Income Tax Slabs

According to the income tax scale for the fiscal year 2021-22, a certain amount will be deducted from the wages of those earning more than Rs. 600,000 / year.

Here’s everything you need to know about the fiscal year 2021-2022 tax credits:

Related Article: Naya Pakistan Housing Scheme | How To Naya Pakistan Housing Scheme 2024

| Taxable Income | Income tax rate in Pakistan |

| If taxable income exceeds Rs. 600,000, but no more than Rs. 1,200,000 | 5% of the amount exceeding RUB. 600 000 |

| If taxable income exceeds Rs. 1,200,000, but not more than rupees. 1 800 000 | Rs 30,000 plus 10% of the amount in excess of Rs. 1,200,000 |

| If taxable income exceeds Rs. 1,800,000 but not more than Rs. 2 500 000 | Rs. 90,000 plus 15% of the amount in excess of Rs. 1 800 000 |

| If taxable income exceeds Rs 2,500,000 but does not exceed Rs. 3,500,000 | Rs. 195,000 plus 17.5% of the amount in excess of Rs. 2 500 000 |

| If taxable income exceeds Rs. 3,500,000 but not more than Rs. 5,000,000 | Rs 370,000 plus 20% of the amount in excess of Rs. 3,500,000 |

| If taxable income exceeds Rs. 5,000,000 but not more than Rs. 8,000,000 | Rs 670,000 plus 22.5% of the amount in excess of Rs. 5,000,000 |

| If taxable income exceeds Rs. 8,000,000, but no more than rupees. 12,000,000 | Rs. 1,345,000 plus 25% of the amount in excess of Rs. 8,000,000 |

| If taxable income exceeds Rs. 12,000,000 but no more than Rs. 30,000,000 | Rs. 2,345,000 plus 27.5% of the amount in excess of Rs. 12,000,000 |

| If taxable income exceeds Rs. 30,000,000 but no more than Rs. 50,000,000 | Rs 7,295,000 plus 30% of the amount in excess of Rs. 30,000,000 |

| If taxable income exceeds Rs. 50,000,000, but no more than Rs. 75,000,000 | Rs. 13,295,000 plus 32.5% of the amount in excess of Rs. 50,000,000 |

| If taxable income exceeds Rs. 75,000,000 | Rs. 21,420,000 plus 35% of the amount in excess of Rs. 75,000,000 |

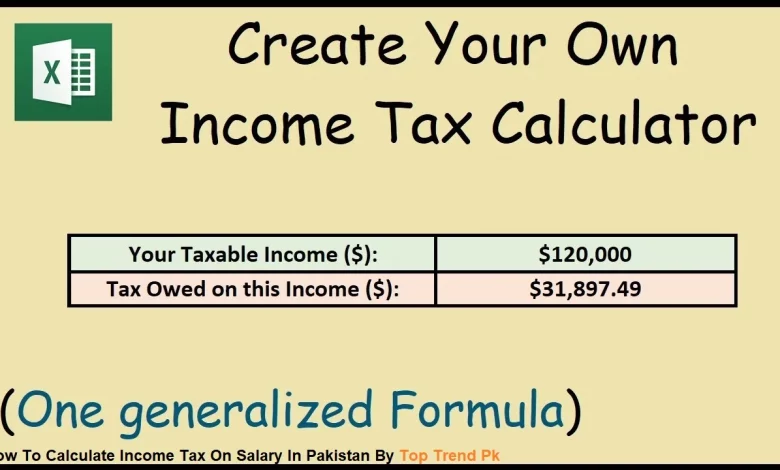

Income Tax Calculation Formula In Excel Pakistan

Assuming our annual income is in cell A2, we will apply the following formula to include all 12 tax brackets. (There must be no pressed [break or Enter] key between formula components).

Here is Top Best Bank In Pakistan 2024 | Best Banks For Freelancers

=IF(A2<=400000,0,

IF(A2<=500000,(A2-400000)*0.02,

IF(A2<=750000,(A2-500000)*0.05+2000,

IF(A2<=1400000,(A2-750000)*0.1+14500,

IF(A2<=1500000,(A2-1400000)*0.125+79500,

IF(A2<=1800000,(A2-1500000)*0.15+92000,

IF(A2<=2500000,(A2-1800000)*0.175+137000,

IF(A2<=3000000,(A2-2500000)*0.20+259500,

IF(A2<=3500000,(A2-3000000)*0.225+359500,

IF(A2<=4000000,(A2-3500000)*0.25+472000,

IF(A2<=7000000,(A2-4000000)*0.275+597000,

( A2 – 7000000 )* 0.3 +1422000))))))))))

FAQ On Calculate Income Tax On Salary

How to calculate income tax on salary with example in Pakistan

If you earn ₨ 240,000 a year while living in Pakistan’s Islamabad Capital Territory, you will be taxed RS 1,560. Your net salary will be Rs 238,440 per year or RS 19,870 per month. Your average tax rate is 0.7%, and your marginal tax rate is 0.0%.

What is the tax on salary in Pakistan?

According to the income tax tables for the 2021-22 financial year, a certain amount of income tax will be deducted from the wages of individuals earning more than 600,000 per year. Previously, this salary tile was not included in the income tax deduction bracket. Now let’s find out more about the latest tax rates in Pakistan for the fiscal year 2021-22.

Salary tax calculator 2024 Pakistan

Download Salary tax calculator 2024 Pakistan Click Here